News

Lotus Institute

Choppy Markets – Global Capital Seeks a New Direction

Release Time: 10:00 AM, October 22, 2025

Released by: Mr. Leon

MARKET OVERVIEW

1. Stock Market

-

Vietnam Market:

VN-Index moved narrowly between 1,660–1,670 as investors waited for market-upgrade news and Q3 earnings. Caution dominated. Watch the 1,650 zone — if it holds, the uptrend may resume. -

U.S. Market:

After strong gains, U.S. stocks are entering a technical consolidation phase. Treasury yields and rate-cut expectations remain key drivers.

2. Forex

-

USD/JPY:

The uptrend is slowing near 150.6–151.5 as markets worry about possible BOJ intervention. The USD remains strong, but momentum may temporarily cool. -

GBP/USD:

The pair remains weak with USD strength dominating. The 1.34 level acts as short-term support; if it breaks, a decline toward 1.33 is likely.

3. Gold:

After a technical pullback, gold maintains a high base near 3,850–3,870 USD/oz. Safe-haven demand stays firm, but 3,880–3,900 is short-term resistance. Failure to break this range may lead to mild correction before recovery.

4. Oil:

Prices hover around 62 USD/barrel, reflecting demand recovery expectations. However, volatility may rise if OPEC+ adjusts output.

5. Bitcoin:

BTC shows a solid rebound after its previous drop, but the 112,000–115,000 zone remains a key test. A clear breakout could signal the return of a medium-term uptrend.

TRADE RECOMMENDATIONS

-

USD/JPY

Trend: Bearish

-

Sell at 151.654

-

Stop loss: 152.054

-

Take profit: 150.854

-

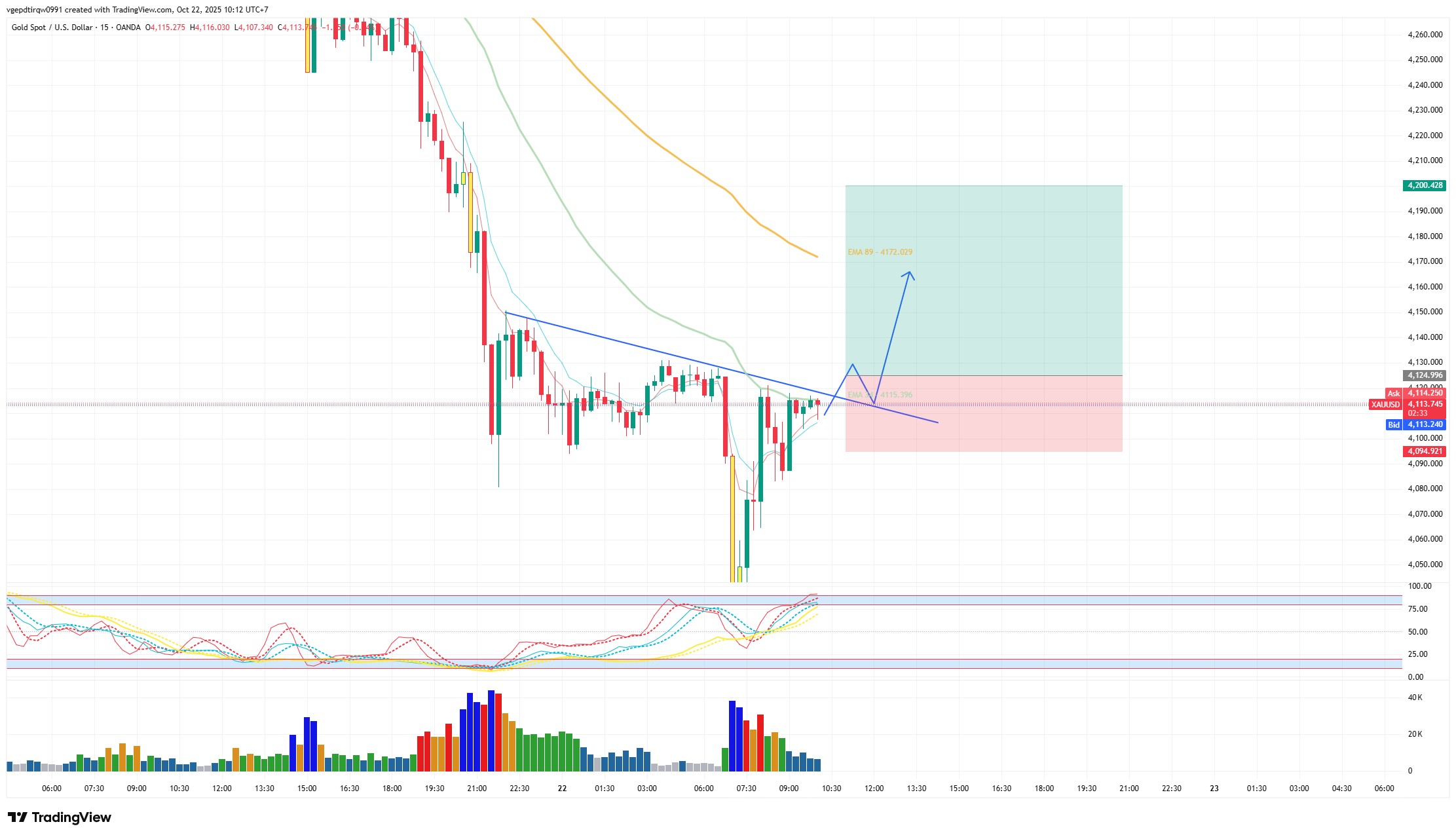

Gold (XAU/USD)

Trend: Bullish

-

Buy when price breaks 4124

-

Stop loss: 4094

-

Take profit: 4172

KEY EVENTS TODAY

DISCLAIMER

-

The above analysis reflects only the personal opinion of analyst Leon from Lotus and does not constitute investment advice.

-

Lotus provides trading technical analysis and educational training only.

-

Lotus is not affiliated with any securities or asset management firm.

-

Lotus does not manage or accept students’ trading funds.