News

Lotus Institute

Market Briefing 04.08 – Reviewing Non-Farm, Gearing Up for a Breakout

Release Time: 10:00 AM, August 4, 2025

Issued by: Ms. Jenny

MARKET OVERVIEW

1. Stock Market

-

Vietnam Market:

The market remained cautious and pulled back slightly but found support around the MA(20) level. Lower trading volume suggests profit-taking pressure is easing. Although the market hasn’t regained upward momentum, three consecutive sessions with long lower wicks indicate the presence of buying interest. However, the negative impact from the previous sharp decline may still cause volatility, and current movements are mostly testing the resistance area around 1,536 points. -

U.S. Market:

The S&P 500 dropped 1.6%, Nasdaq lost 2.2%, and the Dow Jones fell 542 points. Non-farm payrolls came in at just 73K – significantly below expectations – sparking hopes that the Fed may soon cut interest rates. However, President Trump's announcement of new tariffs on several countries triggered a negative reaction. The correction may continue in the short term, but it also creates opportunities for defensive sectors and safe-haven assets like gold.

2. Forex

-

EUR/USD: Uptrend. Medium-term buy positions are favored today. Support: 1.14600

-

USD/JPY: Downtrend. Medium-term short positions are favored today. Resistance: 150.000

3. Gold

Gold is trading within the $3,340–$3,355/ounce range, down about 0.3% on the day, pressured by a strong USD and rising bond yields.

4. Oil

-

XTI/USD: Downtrend. Today’s strategy favors short positions. Resistance: 70.00

5. Crypto

Bitcoin (BTC) gained slightly by +1–1.5%, trading around $114,500–$115,000. This reflects a mild technical rebound, reacting to U.S. economic data and continued pressure from Fed interest rates.

TRADE IDEAS

1. Vietnam Stocks: BWE

Recommendation: BUY BWE (August 4, 2025)

Entry: 48,000 – 49,300 VND

Target 1: 52,500 VND

Target 2: 56,000 VND

Stop Loss: 45,900 VND

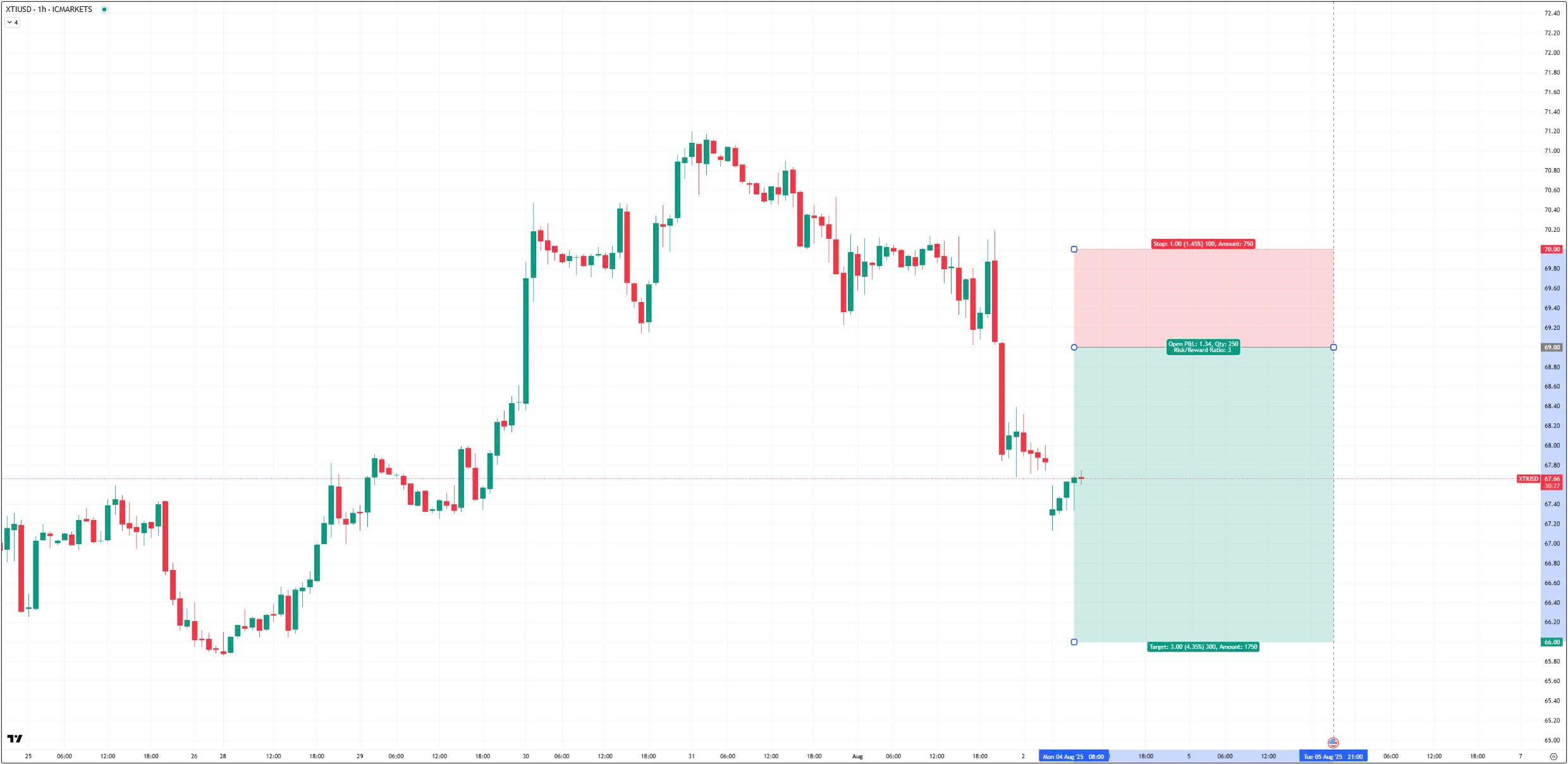

2. XTI/USD

Short-term Trend: Bearish

Trade Plan: Sell at 69.00

Stop Loss: 70.00

Take Profit: 66.00

3. XAU/USD

Trend: Bullish

Recommendation: Buy at 3,322

Stop Loss: 3,296

Take Profit: 3,362

KEY EVENTS TODAY

-

13:30 – CHF – Consumer Price Index (CPI) m/m

-

14:00 – EUR – Spanish Unemployment Change

-

14:30 – CHF – Manufacturing PMI

DISCLAIMER

-

The above analysis reflects only the personal opinion of analyst Jenny from Lotus and is not an official basis for market participation.

-

Lotus provides technical analysis and trading education for students.

-

Lotus does not represent any securities firm or asset management company.

-

Lotus does not manage funds on behalf of students.