News

Lotus Institute

Cooling Inflation Boosts Fed Rate Cut Hopes on Wall Street

Release Time: 10:00 AM, May 16, 2025

Publisher: Ms. Jenny

MARKET OVERVIEW

-

Stock Market:

-

Vietnam Market: The market continues its upward trend but shows signs of tug-of-war with a Doji Star candlestick pattern, indicating rising profit-taking pressure despite continued support from capital inflows and foreign investors. The consolidation is expected to persist, and the market may retest the demand zone around 1,300 points before continuing its move toward the resistance zone of 1,320–1,340 points.

-

U.S. Market: The S&P 500 rose 0.4% to close at 5,916.93, marking its fourth consecutive gain and now just 3.7% below its all-time high. The Dow Jones Industrial Average climbed 0.6% to 42,322.75, while the Nasdaq Composite slipped 0.2% to 19,112.32. April inflation data showed the Consumer Price Index (CPI) rose 2.3% year-over-year — below expectations of 2.4% and the lowest reading since February 2021. Core CPI (excluding food and energy) rose 2.8% year-over-year.

-

Forex:

-

USD/JPY: Expected to see a short-term upward correction, buying opportunities today around support zone 145.000

-

GBP/USD: No clear trend, limited trading today

-

AUD/USD: Short-term uptrend, buying opportunities today, support zone: 0.64050

-

Gold:

-

Spot Gold Price: Trading at 3,252 USD/ounce, up sharply by 132 USD from the overnight session low of 3,120 USD/ounce.

-

Reason for price increase: Strong rally driven by bargain hunting and safe-haven demand.

-

Oil:

-

XTI/USD: Short-term uptrend, buying opportunities today, support zone: 61.00

-

Crypto – BTC:

-

BTC/VND Price: Approximately 2.751 billion VND/BTC, with a 24h high of 2.759 billion and low of 2.681 billion

-

Market Sentiment: Bitcoin continues to trade steadily around 104,000 USD, supported by a recovery in the crypto market and optimistic investor sentiment.

TRADING PLAN OUTLOOK

-

Vietnam Stock – VCG

-

Recommendation: BUY (May 16, 2025)

-

Entry Price: 21,600 – 22,000 VND

-

Target 1: 24,000 VND

-

Target 2: 26,000 VND

-

Stop loss: 20,900 VND

-

AUD/USD

-

Trend: Short-term bullish

-

Recommendation: Buy at 0.64158

-

Stop loss: 0.64048

-

Take profit: 0.64378

-

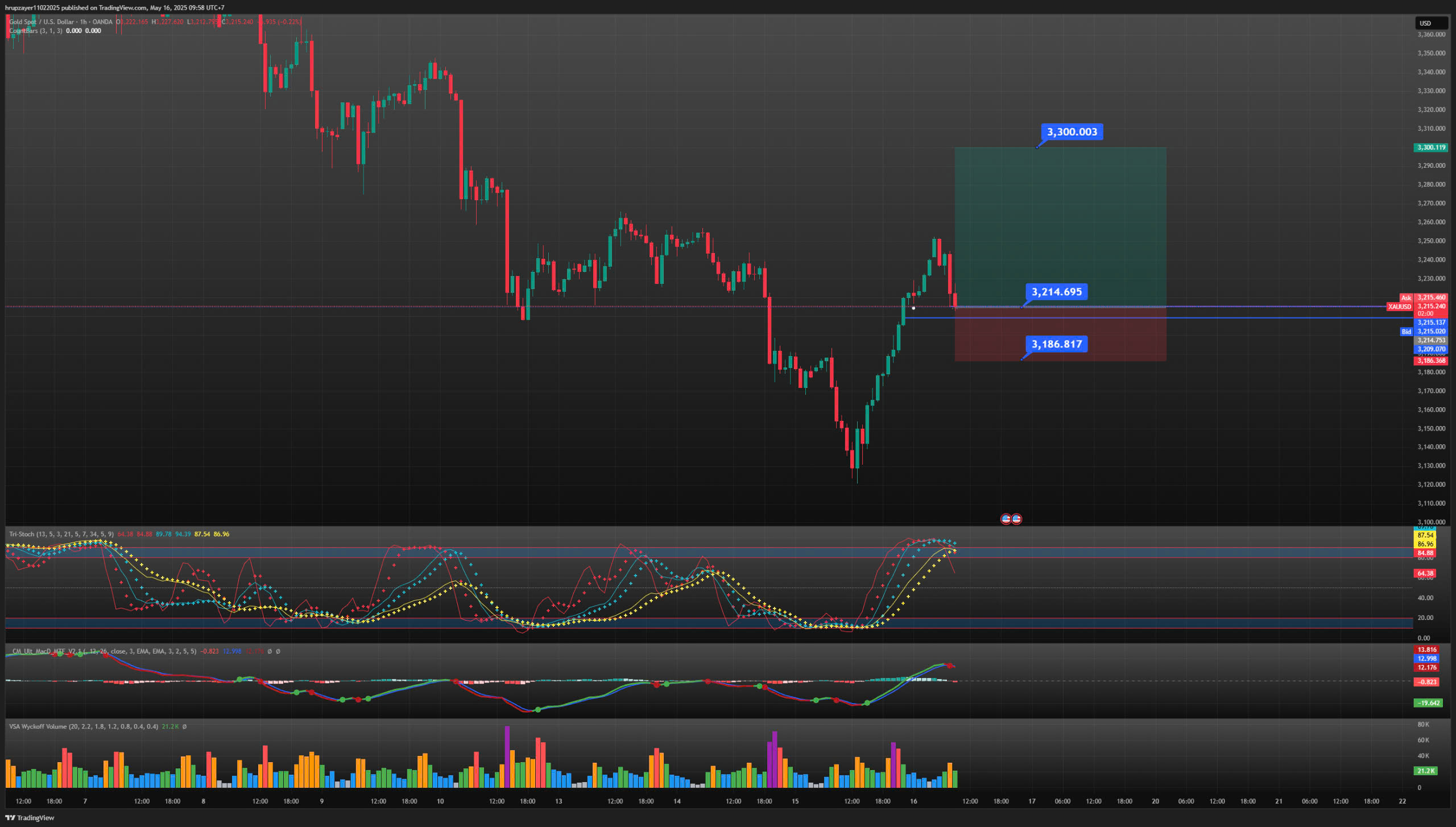

XAU/USD

-

Trend: Bullish

-

Recommendation: Buy at 3215

-

Stop loss: 3185

-

Take profit: 3300

KEY EVENTS TODAY

-

18:00 – CHF – SNB Chairman Schlegel Speaks

-

21:00 – USD – Prelim UoM Consumer Sentiment

-

21:00 – USD – Prelim UoM Inflation Expectations

DISCLAIMER

-

The above analysis represents the personal view of analyst Jenny from Lotus and is not an official basis for live trading decisions.

-

Lotus provides only technical trading analysis and trading education for students.

-

Lotus is not affiliated with any securities firm or asset management company.

-

Lotus does not manage student funds.

_-16-05-2025-10-42-56.jpg)