News

Lotus Institute

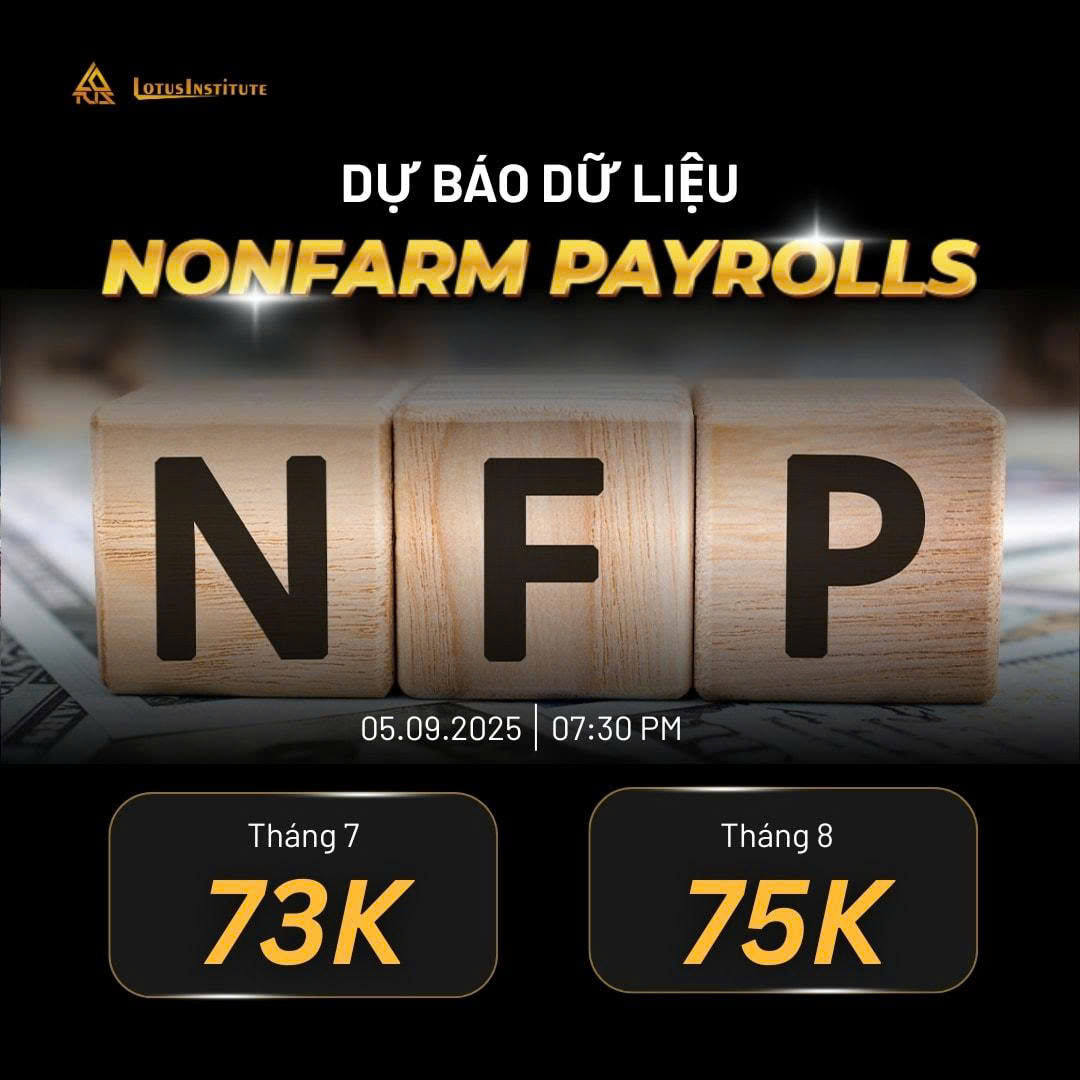

The Whole Market Holds Its Breath Ahead of Tonight’s NFP (September 5, 2025)

Release time: 10:00, September 5, 2025

Released by: Mr. Leon

MARKET OVERVIEW

1. Stock Market

-

Vietnam Market:

The market attempted to rise, approaching the 1,700 level, with improved liquidity, showing that cash flow still supports the uptrend. The current signals may help maintain the upward momentum, but the 1,750 level will be a challenge as supply increases. -

U.S. Market:

U.S. markets surged strongly as the S&P 500 gained 0.8% to a new all-time high, the Dow Jones rose 0.8% (~350 points), and the Nasdaq advanced about 1.0%. The momentum came from weaker-than-expected labor data — slower private job growth and a slight increase in jobless claims — which reinforced expectations that the Fed will cut interest rates this month.

2. Forex

-

GBP/USD: Bearish trend, short positions can be considered today. Daily resistance: 1.35200

-

USD/JPY: Bullish trend, long positions can be considered today. Daily support: 147.800

3. Gold

Based on the latest update, gold rose slightly by about 0.43%, reaching $3,551.33/oz compared to $3,536.29 the previous day.

On September 4, gold showed a mild correction, closing at $3,557.18/oz, down about $9.68, but still remained near its historical peak.

Summary: Gold continues to trade in the $3,550–3,557/oz range, reflecting sustained safe-haven demand, though some profit-taking pressure persists.

4. Oil

-

XTI/USD: Bearish trend, short positions can be considered today. Daily resistance: 65.00

5. Bitcoin

-

Current price: around $111,144 USD, slightly down –0.16% from the previous session.

-

Daily range: low at $109,378, high at $111,664 USD.

BTC is in mild correction but remains stable near the technical support zone around $109k–$110k.

RECOMMENDATIONS

-

VHC (Vietnam stock):

BUY VHC (05/09/2025). Entry price: 57,500 – 58,300 VND.

-

Target 1: 62,000 VND

-

Target 2: 67,000 VND

-

Stop loss: 54,900 VND

-

USD/JPY (Forex):

-

Trend: Bullish

-

Buy at 148.160, stop loss at 147.560, take profit at 149.360

TODAY’S KEY EVENTS

DISCLAIMER

-

The above analysis only reflects the personal opinion of analyst Leon from Lotus, and should not be considered as a basis for real trading decisions.

-

Lotus only provides technical trading analysis and training for students.

-

Lotus does not represent any securities company or asset management firm.

-

Lotus does not manage students’ funds.